* and 2 times when you shouldn’t

These are the 5 reasons why you should trade with real money, instead of always using a demo account. Some will be obvious, and some you may not have thought about. Read on to find out more!

1) Making Money

Shock horror, by trading with real money, you can make real money too! After all, you are not interested in trading purely for the fun of it, are you?

A demo account will give you more ‘money’ to trade with than you would ever imagine. You can make plenty of virtual profit from a demo, but it’s nothing like the same as when you bank some real profit for the first time.

2) Losing Money

More important (yes, I am not kidding) than Making Money are the emotions associated with Losing Money. Boredom, greed, fear and hope; all are emotions you will only truly experience with a real account. It is a rite of passage to lose trades, and an important lesson.

Of course, we do not want you to lose money and that is why we dedicated a full section of our free course to managing your emotions. You can find that and the rest of our course here.

3) Commitment

Are you serious about your trading journey? It’s time to get serious about real trading then. Once you commit to investing in a real account, you have taken that next step towards freedom.

You are now committed to your trading. You have invested your own money in it. The very fact that you have invested your hard earned money will spur you on to continue learning and, hopefully, earning.

4) Persistence

With a real account you will build up resilience. One of the key differences between people who are successful and those who are not, is that they do not give up.

It is inevitable that you will experience drawdown (you cannot win them all), but it is how you react to this that dictates how you are as a trader. You do not get the same experiences on a demo.

5) Compound Interest

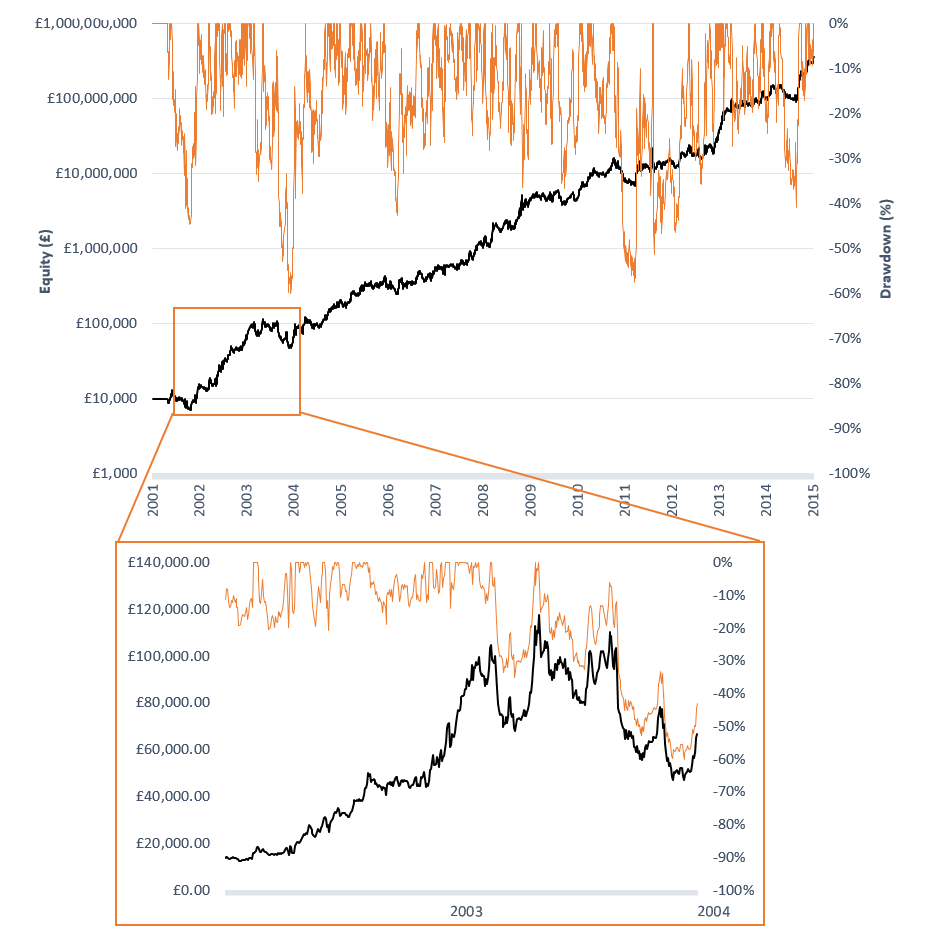

Compound interest is the single most powerful tool at your disposal. It is achievable to make a consistent 10% per year; in fact it could be much higher than this if you are successful.

The black line is the equity in the account, and the orange line is the drawdown. This model is based on real historical trading data. It highlights the losing periods as well as the winning ones.

In 2003 the account would have experienced a drawdown as high as 60%. Many traders would have stopped at this point. However, with persistence the account reached £1 million in the following 5 years. This shows you the power of compound interest.

*When you should use a demo account:

Despite the above 5 points on why you should trade with a real money account, there are important times when I absolutely recommend using a demo account.

Firstly, when you are completely new to trading. You have to learn how everything works, which is much easier (and safer) when you are not risking money. Do not use a real account until you are familiar with the basics. I recommend practising on a demo account for at least 1 month. If you study our course and practise regularly, you should be ready to switch to real money by then.

Secondly, when you are switching to a new broker. Unless you use the metatrader platform, each broker will have its own user interface and quirks. It is essential to understand how to use the platform properly before you start risking your own money. This should only take you a few hours, or even less. Once you know your way around, then you can get back to trading with real money.

In Summary…

Those were the 5 reasons why you should trade with real money. Trading with real money will make you feel emotions that are simply intangible on a demo account. Everything changes when it is your own money on the line. It can be exciting but you must exercise prudent money management or risk failure. Start your journey on a demo, then upgrade to a real account to truly start your journey towards financial freedom.