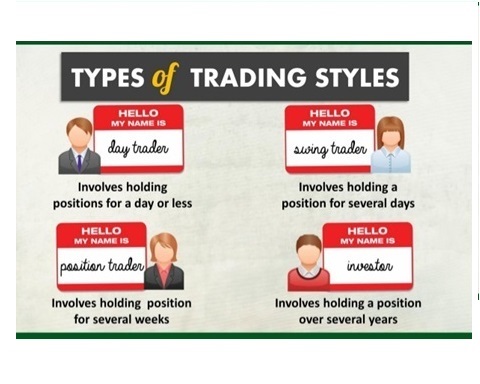

The amount of time a financial instrument is held by a trader defines their style of trading. The type of trader you are, or choose to be, will be highly dependent on your personality. Do you prefer to have complete oversight over your work, investing the greater part of your day into perfecting your projects? Or are you like myself at The Two Traders, happy to invest effort into shorter periods of time for maximum output, making it possible to pursue many goals at once?

Investor versus Trader

Firstly, it’s important to differentiate between investors and traders. Investors will buy and hold financial instruments over many years, allowing the market to fluctuate in the hope that the overriding trend is positive for their investment. Traders, on the other hand, will buy and sell financial instruments (shares, Forex, commodities, etc.) on a far more frequent basis that can range from minutes to weeks.

Technical vs Fundamental Trading

The reasoning between trading decisions falls broadly into two categories: Fundamental traders and Technical traders. The difference in style between the two is significant. Fundamental traders spend their time analysing the factors affecting supply and demand, whereas technical traders care primarily about the price, spending their time focused on the charts.

Technical trading involves the use of price data to spot patterns on graphs that indicate when a change in normal price behaviour has changed. There are a huge variety of technical indicators, all with advantages and disadvantages, which are used to estimate what the price is likely to do next. These are further explained on the Get The Trading Edge tab of our website.

Fundamental trading is based on estimating a fair value of an instrument based on supply and demand, and identifying if the market has over or under-priced that instrument. If the price does not reflect the current earnings report of a company, for example, then this may be an opportunity to buy or sell, depending on the reports results. The issue with fundamental analysis is that even though you may feel you have accurately estimated the value of a given instrument, there may be factors that you were not aware about, making it difficult to enter and exit a trade accurately.

this is very different to the other types of traders, why is it relevant and what are you trying to say? do the types of traders either technically or fundementally trade, or are these two more types of traders in themselves? and if so why arent they separate?

Technical traders can be broken down by the about of time trades are held for, and the frequency of trading. Which one of these you decide to be is highly dependent on your personality.

Trader Number 1 – Day Traders

The 9:00am to 5:00pm traders. These traders watch the charts all day, closing positions before their trading day ends, and don’t hold positions overnight. They close at a profit or a loss that day and move onto the next.

Character traits:

– Patience: Day traders spend a lot of time watching the charts. You need the ability to wait for good set-up opportunities to occur before entering, and there may even be whole days without making a trade.

– Discipline: Day traders need the discipline to not over-trade, such as making trades out of boredom, and to be able to execute a trading plan consistently.

– Mental toughness: There are inevitably going to be bad trading days, where a day trader spends all day at the charts simply to finish the day at a loss. A good day trader has the mental toughness to not allow his trading to be clouded by these.

My view

I tried this type of trading and found it to be exhausting. It was difficult to gain an edge as this kind of trader, as trading on a shorter time frame means that you are susceptible to trading during periods of random price movement. However, if you are patient, disciplined, and are happy to commit a significant portion of your day to the charts, then you might be suited to day trading.

Trader Number 2 – Scalpers

The short term traders. Scalpers make a trade every few seconds or minutes, making a profit (“scalping”) by exploiting the difference between the buy and sell prices, also known as the spread. The idea behind scalping lies in the notion that numerous small profits can equal a bigger sum if hundreds of trades are made per day.

Character traits:

– Fast Thinking: Decisions need to be made rapidly and acted on without hesitation, so scalpers need the ability think and react quickly.

– Impatient: Counter intuitively, impatient traders tend to make good scalpers because they expect trades to be profitable quickly and will therefore exit trades quickly if it moves against them.

– Excellent Focus: because this trading style is short termed, it required significant concentration to make sure opportunities are not missed.

My view

Scalp trading is almost entirely dominated by computer algorithms that have the speed advantages over those manually entering trades from their home computer, making it a somewhat redundant method of trading in the age of automation.

Trader Number 3 – Swing Traders

The medium term traders. Swing traders can hold trades from a day to a few weeks at a time, making profit from the smaller trends within markets that investors ignore. Due to the nature of swing trading, this type of trader only needs to review their positions a few times a day.

Character traits:

– Patience: Keeping trades open for several days or weeks requires patience and the ability to sit back and let profits run.

– Hands off approach: Swing trading requires a small daily time commitment, so traders need to be able to get on with their day-to-day lives comfortably with trades running in the background. For most this is easy, but some people may be nervous holding trades while away from their computer.

– Mental Toughness: emotions are the enemy of all traders. Swing traders need discipline and consistency just like traders working at shorter time frames.

My view

Swing traders are who I identify with most closely. The Swing trader approach allows me to only check my trades once a day whilst still making a profit . I found this to be the most favourable approach to take since my goal was always to achieve financial freedom (not spend all my time watching the charts) and can be balanced around work, studies or travel.

Trader Number 4 – Momentum Traders

The opportunistic traders. These traders look for big price movement and big volume in one direction, where volume equals the amount a financial instrument was traded over a given time frame. They look to make profit by riding a momentum wave.

Character traits:

– Opportunistic: Big momentum waves typically happen when the market is taken by surprise (think Brexit). Momentum traders look to capitalise on these events and are usually people who are not afraid to get involved when others are panicking.

– Interested in current events: Momentum traders need to stay on top of upcoming economic events in order to plan how they will trade for various possible outcomes.

– Fast thinking: These big price moves are usually fast, so momentum traders need to act quickly and rationally under volatile conditions.

My view

Momentum trading can be difficult as the trader must be at the right place at the right time. The good news is that the timing of momentum trades usually coincides with known news events, meaning that it could be a good style for a person with an eye on current events.

The Two Traders

Choosing the trading style that best suits you can be a difficult task, but it is necessary to your long term success. You may wish to try a few styles out first before deciding, and you may find that your lifestyle limits your choices (For instance, if you are working during the day, it is likely Swing Trading will be the most sustainable approach).

No matter which style you land on, the principles of trading, and many of the strategies used, are the same (only the timeframes you trade them on differ).