This blog is going to talk about one of the topics I receive more questions on than anything else: leverage and margin. More specifically, how these two characteristics of trading can enable you to utilise your equity to its maximum, whilst understanding the potential downsides and risks.

Let us imagine we have a single Gold contract which consists of 100 troy ounces. If the price of Gold is $1,000 per ounce, we have a contract value of $100,000. This amount of money would seem unobtainable to the newbie trader or even most established part time traders, but many traders can afford this type of contract thanks to margin and leverage.

Margin

Margin is essentially a promised deposit – Promised meaning it is not paid upfront and deposit meaning that you must have a minimum amount of money/equity in your brokerage account. There are two types of margin, initial margin and maintenance margin. The initial margin is the amount of money that must be in your account to open the buy or sell (short) a given financial instrument. The maintenance margin is the amount of money you must hold within your account whilst your buy or sell trade remains open.

The margin required to open/keep a position varies by market, and by broker, but is often only a few percent of the contract value. This is an advantage if you don’t have access to the full equity required to open a trade, meaning you can have a lot more positions open at any given time. So, using our previous Gold contract example, to enter this trade with a 10% margin, you would only require $10,000 in your account at any given time.

Margin does have its downsides. You must remember that you still own an investment worth $100,000. Having enough equity to place a trade and being able to afford a trade are two completely different things.

For example, a reduction in Gold prices of 5% would mean you would lose $5,000 on your initial investments. You must have had at least $10,000 to place this trade, but if you total account size was $20,000, you would have lost 25% of your account from this one single trade. This is the difference between being able to place a trade and being able to afford the trade, and why so much emphasis is placed on risk management. Some brokers offer even lower margin requirements, with the lowest initial margin I have seen at about 0.3% (available with my preferred brokers), which means you would only require $300 to open this Gold trade.

Leverage

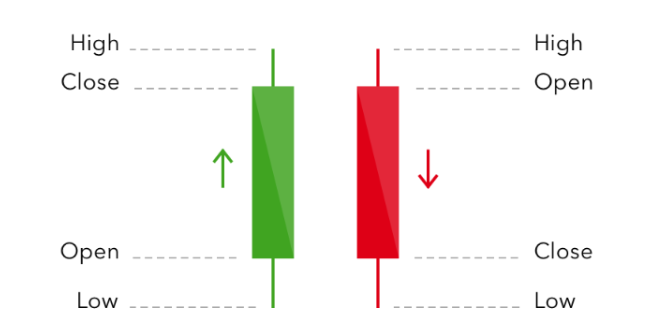

This is the ability to buy/sell a financial instrument with only a fraction of the equity, and although it is like margin it is not the same.

Leverage is based on multiplications of your initial investment. Let’s say you are buying a GBPJPY pair and you want $60,000 worth. This is a lot of money to hand over at any one time, especially when this money could be invested in other places. That’s where leverage comes in. If you can receive a leverage of 1:100, or 100 to 1, you only need to spend $600 on this $60,000 investment. This means you can use the remaining $59,400 on other investments, making your capital work best for you.

However, leverage is a doubled edge sword and can either make or break you. Using the same example and assuming you have a $2000 account size let’s say GBPJPY is trading at 140.00 and you purchase $60,000 at this time. Using only $600 of your total equity for the trade due to the 1:100 leverage. If the price moves up to 145.00 you will have made $2,142 profit, doubling your account size overnight. But if it moves down to 135.00 you will have lost $2,142, blowing your account overnight. This is because the underlying value of the financial instrument purchased is the same, the only thing that changes with leverage is the amount of money you pay to open a given trade.

Leverage and Margin work together

Using the same GBPJPY example, purchasing $60,000 with only leverage at 1:100 would have immediately cost you $600. However, if you were using margin, you can promise a deposit of $600, instead of paying it outright. Meaning this $60,000 investment does not lock up your equity in that immediate instance. Instead means you must have that much capital in your account to keep the position open.

Learn to think in terms of risk

You’ve seen how leverage and margin can be used as a way to use your capital more efficiently, and have access to higher position sizes, but they should not be considered as standalone concepts. They are useful tools that you have access to in order to control the most important parameter of all: your risk. People get too hung up about ‘what leverage should I use’, when the reality is it makes no difference – what makes the difference is your risk. Let me give you an example.

Example

Imagine you have a $1,000 account, and you want to buy oil at $50, with your stop loss at $45. Your first question should be, ‘how much of my account am I willing to risk on this trade?’ (If you don’t know how to answer this question, make sure you watch these videos before you do anything!)

Let’s say you settle on a 2% risk (A sensible figure), then you should risk $20 of your account on this one trade. Since your stop is $5 wide, which is 10% of your entry price, you need a $200 position – when the market drops 10%, your contract drops 10%, which is $20. You have $20 of risk.

There are many ways you can do this. You could have a $200 position with no leverage, or you can have a $20 at x10 leverage, or even a $2 position with x100 leverage. The result is exactly the same.

So next time you ask yourself ‘what leverage shall I use’, stop, and think instead ‘what is my risk, and how can I use leverage to achieve that?’

The Two Traders

If you want to start trading click here or visit our Trading Course tab to start learning