One of the biggest hurdles that new traders face is access to capital. As such, one of the questions most asked is how much people will need to start with to make a lot of money. The reality is that a small amount of capital can be turned in to a very large amount of money through the effect of compounding growth.

This means that as your account grows, your position size grows with it. This requires you to reinvest your profits. Investing in yourself is one of the key traits of successful people. Too many people are quick to ‘cash out’ profits too soon, and they cripple their potential to make the big bucks!

When I first started I was risking about $30 a trade – making it very difficult to make any real money. Now that my account size has grown significantly, I risk over $1000 on a trade. This means a 3:1 risk reward trade increases my account by $3000. If I had been cashing out along the way and not growing my account? It would be a measly $90.

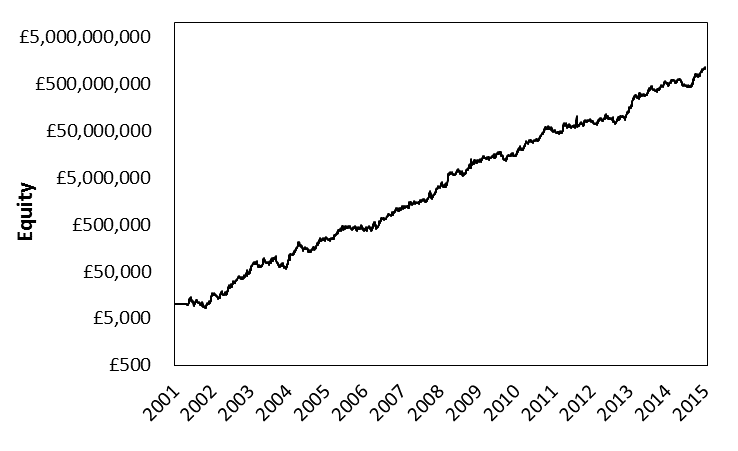

The graph below shows the back-tested results of my system for over 3000 trades, theoretically turning $10,000 in to $500m over 15 years – Assuming every penny was reinvested. If you kept cashing in your all profits, you would be stuck where you started.

Past performance does not indicate future results

It seems ridiculous to imagine such a small sum can be grown so much. To give some reference (and hopefully some inspiration), here are some real examples:

- Ed Seykota – Turned $5,000 to $15million in 12 years

- Michael Marcus – Turned $30,000 to $80 million

- Richard Dennis – $5,000 to over $100 million (Famous from ‘The Way of The Turtle’)

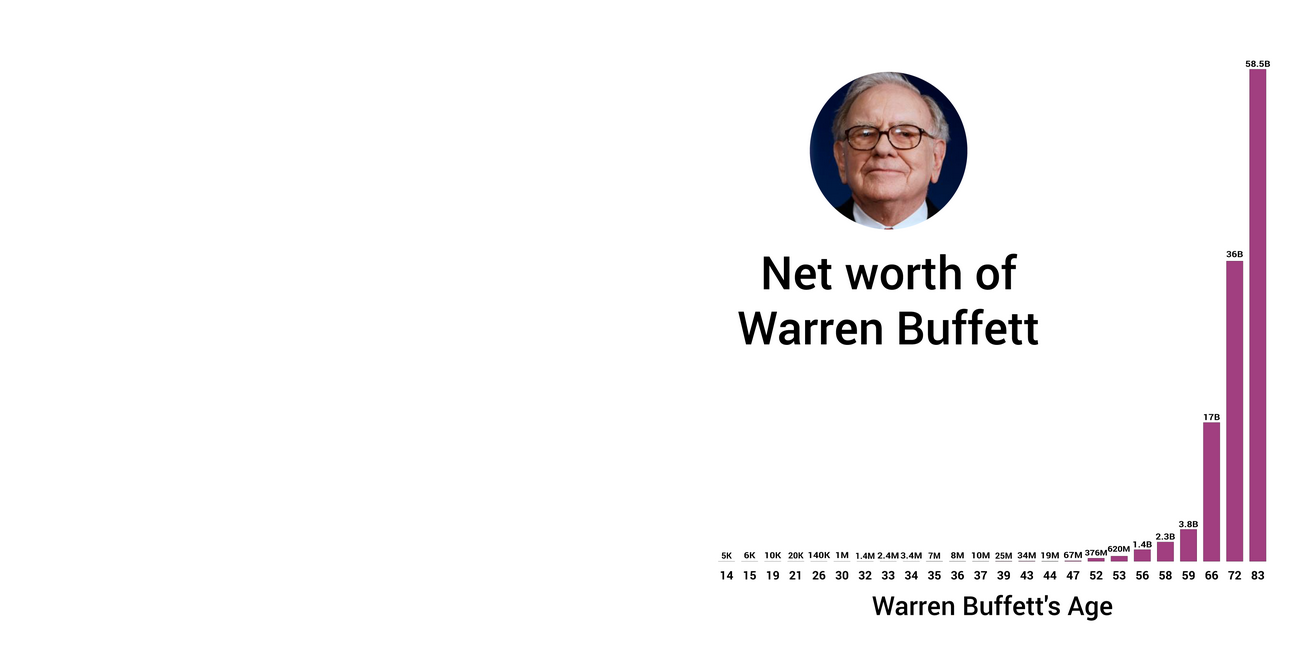

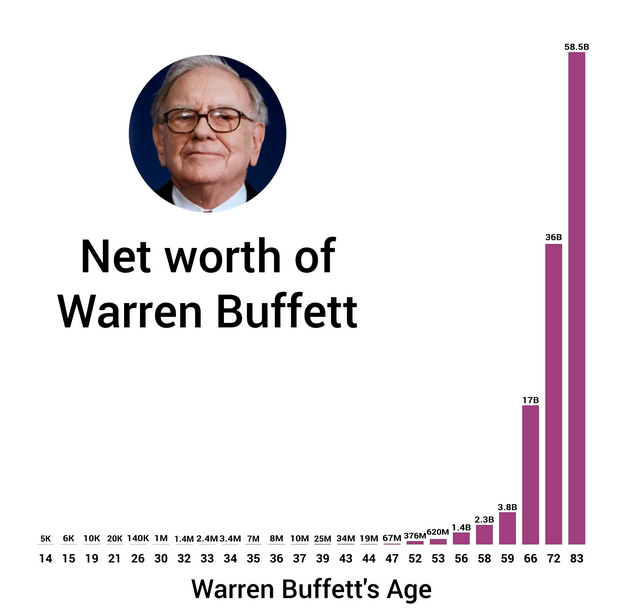

- Warren Buffet & George Soros – Have both averaged returns of around 30% per year for nearly 20 years. Warren Buffet has turned $6,000 in to $83 Billion,

‘The First Million is the Hardest’

There is a famous saying in trading that ‘The First Million is the Hardest’. The reason behind this comes down to the principle of compounding growth.

Imagine you are doubling your account every year – a very impressive feat in itself – and you started with an equity of $10,000. It would take you 4 years to make your first $100,000, and another 3 years to get to $1,000,000. But how long does the next million take? It takes one year. So you make what took you 7 years to make to begin with, in just 1 year.

It took me over a year to build my account up to my first $10,000. It took me just 12 days to get my last $10,000, with $5,000 of that in just 24 hours! You can learn EXACTLY the rules I use to build my equity now

This is why I emphasise patience heavily as a characteristic of good traders. Once you are able to trade consistently, you will gradually make larger and larger returns (provided you reinvest in yourself). Warren Buffet wasn’t a millionaire until he was 30. Now he is one of the richest men alive – all thanks to patience, consistency, and the beauty of compounding growth. He has ‘only’ averaged a return of 30% a year return on investment, but it stacks up exponentially over time.

Source: https://www.marketwatch.com/story/from-6000-to-67-billion-warren-buffetts-wealth-through-the-ages-2015-08-17

What’s the lesson here?

The key to making the millions, is not to chase them. It sounds counter-intuitive, but getting greedy too soon is likely to slow you down – this is why rich people are often tight with money. They prefer to reinvest in themselves rather than live like rich people (This is obviously not true to everyone – sports starts are notorious for flaunting their money. They are also notorious for going bankrupt when they retire). Don’t believe me? Watch Shark Tank investor Kevin O’Leary, with an estimated worth of $400 million, tell you why he won’t even pay $2.50 for a coffee.

Focus on developing good habits, mastering yourself and re-investing in your potential. The future you will thank you. Don’t wait around, start learning today

The Two Traders

Start trading now or visit the Get The Trading Edge tab to start learning