This is my number one rule when it comes to trading – cut your losses early.

When it comes to trading, managing your risk is the most crucial element to future success. This means knowing when you’re wrong and doing something about it.

Unfortunately, this goes against our natural instincts – we like feeling of ‘winning’, and will often delay the possibility of loss with the HOPE that things will turn back in our favour. Do not trade on hope, this is what losers do. It results in emotional decision making and is a manifestation of fear – the fear of losing a trade. Winning traders have DISCIPLINE and know when to take the hit.

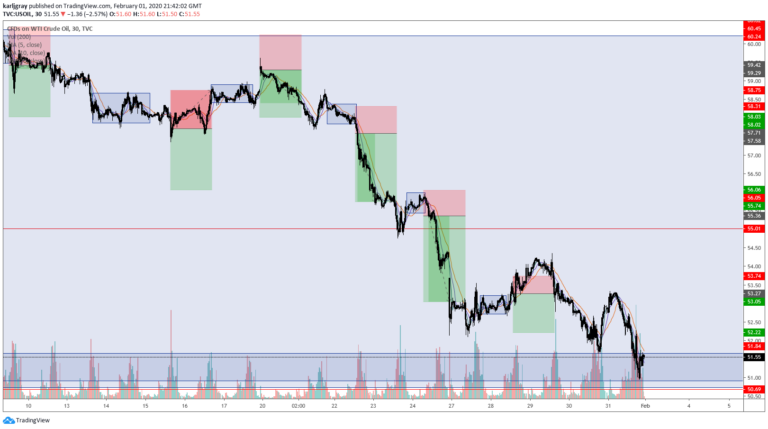

Example

The scenario usually goes something like this. A trader enters a trade, on Oil for example, and says to himself ‘I only want to lose $100, so I will close out if the market goes below $100’. The market starts moving against him, and he starts to get scared. When the market reaches his $100 loss level, he decides to give it a ‘bit more time’. Maybe it will turn back around? The market maybe bounces back to an -$80 loss, which gives the trader hope that it will turn back. They might have seen a post or a news article or heard someone say that Oil is going to go up, so they use this to positively reinforce their hope.

Unfortunately, the market moves down further and they are now holding a $150 loss. Well they wouldn’t take the loss at $100, so why would they take a $150 loss? It goes down further, and further, and the trader thinks the market MUST bounce back! In the worst of these scenarios, the trader will keep adding more positions to their losing trade, convincing themselves they are getting a better price each time rather than accepting that their view is wrong.

Just imagine not being able to accept your loss against this mammoth Oil move in 2014-2015.

If this scenario sounds all too familiar, (as it probably will to most traders) you need to act on it NOW! It is a habit that will run your account in to the ground one day, if it hasn’t already.

The way to cut losses early is to make sure you use a stop loss. The importance of this cannot be emphasised enough.