Welcome to our comprehensive trade analysis for January 28, 2021. In today’s update, we delve into the key forex pairs, analyze current market trends, and outline our strategies for potential profitable trades. Whether you’re a seasoned trader or new to the forex market, this analysis will provide valuable insights to help guide your trading decisions.

Market Overview and Trends

As of January 28, 2021, the forex market continues to experience significant volatility. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY have shown notable movements driven by recent economic data releases and geopolitical events. Understanding these trends is crucial for identifying trading opportunities and managing risk effectively.

- EUR/USD: The EUR/USD pair is trading within a narrow range, with resistance at 1.2150 and support at 1.2100. We expect a breakout to the upside if positive economic data from the Eurozone continues.

- GBP/USD: The GBP/USD pair has been bullish, testing the 1.3750 level. Key factors influencing this movement include Brexit trade deal optimism and a weaker US dollar.

- USD/JPY: USD/JPY is currently in a downtrend, with significant resistance at 104.50. The ongoing risk-off sentiment in global markets has led to increased demand for the Japanese Yen as a safe haven.

Currency Pairs to Watch

Based on the current market analysis, here are the key currency pairs to monitor closely:

- EUR/USD: Watch for potential breakouts above 1.2150. If this level is breached, we could see further upside momentum.

- GBP/USD: Pay attention to any pullbacks towards 1.3700 as buying opportunities. A sustained move above 1.3750 could open the door to further gains.

- USD/JPY: Monitor the 104.00 support level. A break below this could signal further downside potential.

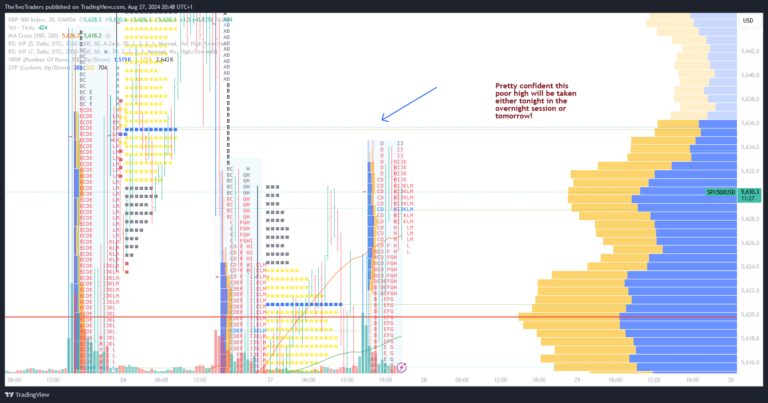

Technical Analysis and Indicators

Our analysis leverages several technical indicators to identify key support and resistance levels and to predict potential price movements:

- Moving Averages: The 50-day and 200-day moving averages are closely watched for crossover signals that may indicate bullish or bearish trends.

- Relative Strength Index (RSI): The RSI indicator suggests that GBP/USD is currently overbought, indicating a possible short-term correction.

- Fibonacci Retracement: Used to identify potential support and resistance levels, particularly on the EUR/USD and USD/JPY pairs.

Trade Strategies and Recommendations

Based on our technical analysis, we have identified several potential trading strategies for today’s market:

- Trend Following on GBP/USD: Given the bullish momentum, consider a long position on GBP/USD with a stop-loss at 1.3700 and a target of 1.3800.

- Breakout Strategy on EUR/USD: A breakout above 1.2150 could provide a good entry point for a long trade, with a stop-loss set just below 1.2100.

- Countertrend Trade on USD/JPY: For traders looking to trade against the trend, consider a short position on USD/JPY if it fails to break above 104.50, targeting a move towards 103.50.

Key Takeaways and Risk Management

- Always ensure to use stop-loss orders to protect against unexpected market reversals.

- Consider the risk-reward ratio carefully before entering any trades. Aim for at least a 1:2 risk-reward ratio to maximize potential profits while minimizing losses.

- Stay updated with the latest economic news and market events that could impact currency prices.

Conclusion

Today’s forex market offers several potential trading opportunities across key currency pairs. By staying informed and utilizing technical analysis, traders can better navigate the market’s volatility and make more informed decisions. Remember, effective risk management and a disciplined approach are key to successful trading.

For more in-depth analysis and trading strategies, be sure to explore our other articles and resources. Stay tuned for our next market update!