Trading is often seen as a field that is associated with an extremely niche skillset. In 1983, legendary traders Richard Dennis and William Eckhardt conducted what later became known as ‘The Turtle Experiment’ after Dennis turned an initial stake of less than $5,000 into more than $100 million. The hypothesis was simple: they wanted to prove that anyone could be taught to trade, so Dennis found a group of people who after two weeks of studying his rules were made to trade with real money.

The result? The two classes Dennis personally trained earned more than $175 million in only five years.

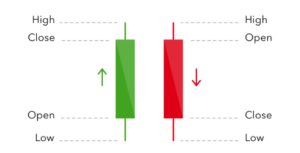

What Dennis and Eckhardt did in 1983 relied on the principle of ‘trend following’. Trend following is a trading style that relies on technical analysis to identify when trends are about to begin, and from then onwards to keep you in them for as long as possible. The principle uses simple rule based strategies that can be learned and applied by anyone.

You Can Learn Too

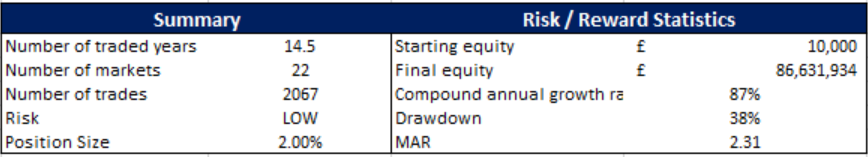

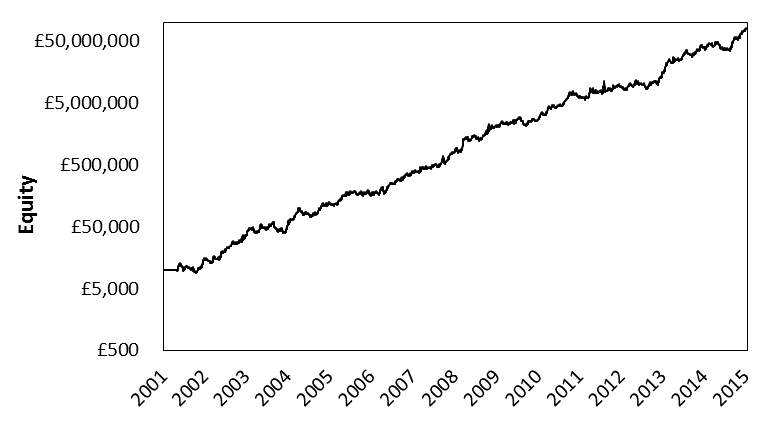

Once I’d read ‘The Way of the Turtle’ – the written account of Dennis and Eckhardt’s experiment – I spent over 6 months studying and testing similar trend-following trading systems. You too are going to learn the same principles and I’ll be on hand whenever you have any questions on how to trade in this way. The system I designed below showed an average annual return of 87% for a 15-year sample period (over 3000 trades) by trading for only 15 minutes a day. That’s enough to turn $10k into nearly $100 million!

The Results So Far?

I am currently two years into trading the trend following system shown above. The table below shows the real results*, and proves that using a trading system can generate exceptional returns – having generated a return on investment of +422% since beginning systems trading.

Statistics: +422% since starting system trading

| 2015 | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 156% | 156% | |||||||||||

| 2016 | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 18% | 37% | -29% | 3% | -19% | -6% | 7% | 4% | -3% | -6% | 47% | -1% | 32% |

| 2017 | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| -21% | -5% | 8% | -11% | 4% | 20% | 35% | 9% | -3% | 1% | 19% | 56% | |

*Past performance is not an indication of future results

You will also discover the tools and skills that will help you trade consistently and profitably. Whether you have tried trading before, or are starting from nothing, you will be taken through the steps to long term profitability – and don’t hesitate to come to me for any questions.

Road to Trading

The table below was created to give you an overview of what you will learn with The Two Traders. You can work through the content however you like, at your own pace, and discuss with other traders on the Facebook page or email me directly.

Each of the sections below comes with a comprehensive guide and video tutorial. The videos are focused on real examples as it is crucial to spend time analysing the charts, so go through each guide and video as a pair.

The fastest way to learn how to trade is… to trade. Firstly in virtual demo mode, then with a real account (start small, and never invest more than you can afford to lose). Bear in mind that some of the most important sections, the Trading Psychology Blogs and Money Management Guides, will far more sense once you move on from demo mode to a real account. And most importantly, you will need to set-up an account to get started.

Stay active on the website and Facebook community- there will be a lot of people going through the same ups and downs as you, and sharing analysis will greatly accelerate the learning process!

| Time | Action | Videos & Guides |

| Week 1 | ● Set up trading account

● Familiarise yourself with user interfaces on demo mode |

● Setting up an account & how to deposit

● Basics o Markets o Market Players o Buying/Selling o Leverage o SL o TP o Orders |

| Week 2 | ● Go through the charts and try and spot the various patterns

● Test your knowledge by trading the patterns in demo mode ● Share your analysis with other users in the chatroom! |

● Technical Analysis: Patterns

o Support/Resistance o Trend Channels o Consolidation o Flags, pennants and triangles o Double tops and bottoms o Rounding tops and bottoms o Head and shoulders o Gaps |

| Weeks 3 & 4 | ● This the more advanced technical analysis, so spend some time making sure you understand this

● Go through the charts again and look for trends. Try some of the systems we discuss and find when they work better and not so well ● Begin trying to develop a repeatable system from what you have learnt |

● Technical analysis: Technical Indicators

o Moving Averages o Filters o Average True Range o Bollinger o Donchian o Exit Strategies o Time Based o MA Cross ● Setting up spreadsheet |

| Week 5 | You may feel you are ready to start trading real money at this point. Make sure you only invest what you can afford to lose and make sure you go through our psychology and money management guides! | ● Trading Psychology

o Failure & how to cope o Loss aversion o Emotions o Drawdowns o Persistency ● Money Management o Position Sizing o Drawdowns o Exposure o Price Shocks o Diversification o Pyramiding |

| Week 6 onwards | Trading is a constant learning process, and complacency is a recipe for failure. Continue to watch the new videos and blog posts, and stay involved in the chatroom. | ● Blog posts

● New videos ● Chatroom |

The most important factor that will determine whether you become a successful trader or join the majority of losers will be your commitment to learning: trading is not something you are born with, it MUST be learned!

The Two Traders

Start trading now or visit the Get The Trading Edge tab for more free content