As you no doubt keep hearing on the news, we are living in unprecedented times. The markets have seen record falls across the board, and Crude Oil is no different, as it hits an 18 year low. What is driving this? Is now a good time to buy oil? Read on for my thoughts…

Why Is Oil Important?

Crude Oil, sometimes known as Black Gold, is an essential resource in the vast majority of items that we use in our daily lives. It is the primary source of energy production in the world. To understand the market, we must first understand the origins of the commodity itself. Crude Oil is extracted from reservoirs deep underground. Crude Oil is made of long chain hydrocarbons; these are long chains of carbon and hydrogen atoms connected together. When fish die, their carcasses fall to the bottom of the ocean and get buried by sediment. Over millions of years, immense pressure from the weight of the ocean and sediment converts these remains into Oil.

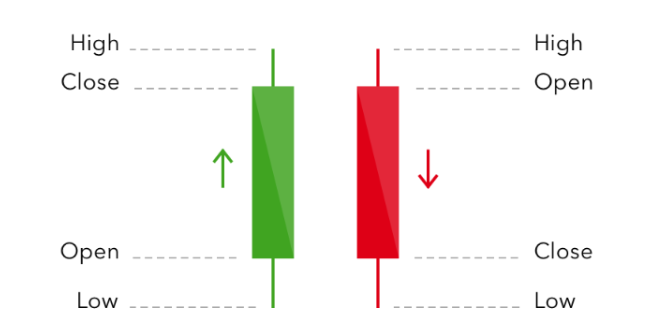

How Can You Trade Oil?

Oil is known as a Commodity, and can be traded just like any other market. There are two types of Oil contracts that you can trade: West Texas Intermediate (WTI) Crude is the benchmark for North America and is more sensitive to American economic developments; whereas North Sea Brent Crude is the benchmark for Europe, Africa and the Middle East. At The Two Traders, we watch both of these markets but primarily focus on WTI Crude – the code for this on our broker is OIL.WTI.

What Are The Fundamentals?

Right now, the OPEC+ (Organisation of the Petroleum Exporting Countries) are meeting to discuss how much to cut the supply of oil. The crucial point to understand when looking at fundamentals is not whether a decision is taken, but whether that decision meets or does not meet the market expectations. In this case, the market expected a significant cut in production of 10 million barrels a day or more.

However, as shown in the dramatic 9.3% fall on Thursday, an agreement has not yet been reached – Mexico has been a sticking point, claiming they are unable to meet the expected production cut. Even if the OPEC+ meeting agrees on a 10 million barrel a day cut in production, the price could still fall further; the estimated reduction in demand is reportedly closer to 30 million barrels per day!

What Are The Key Technical Levels?

The last 3 months have seen a whopping 66% drop in the OIL.WTI price, from $60 all the way down to the low at $20. However, compared to the fall during the financial crisis of 2008/9 it is relatively small; from July 2008 to January 2009 the price fell from $140 right the way down to $30. On the 30th March, the Oil price reached its lowest point since February 2002 – an 18 year low.

The significance of this is not to be overlooked. The longer the period since a price point has been reached, the more significant the level. In addition to this, the value of $20 a barrel is an important psychological level simply because it is a round number. These factors combined make the $20 mark a strong support level, which seems unlikely to be broken.

Looking ahead, the bearish rejection in the last few days indicates that the market may come close to retesting the $20 support level before heading up. Whether it reaches this level will be dependent on how quickly a deal is agreed at the OPEC+ meeting. The next resistance level to look out for to the upside is around the high of 3rd April at $29 to $30.

Is It A Good Time To Buy Oil?

In short, no it isn’t. Why? As traders the golden rule is to trade with the trend. At this moment in time, the trend is bearish so it is not suitable for long positions. When there is confirmation of an upwards movement, perhaps the breaking above the $30 mark, that will be the time to buy. It is important to note, however, that the demand for Oil will remain low until the Coronavirus lock-downs have been lifted.

For more information on the background behind Oil markets, we recommend checking out Investopedia.

Are you new to trading? We recommend starting with our trading course.

This communication must not be reproduced or further distributed without our prior written permission. Nothing in this communication contains investment advice. All information provided is gathered from reputable sources, but any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Please see our full Risk Warning for more.