Diversification is one of the most crucial elements to trading success, and simply put, it means don’t put all your eggs in one basket. Diversifying your investments enables you to draw on the fact that some markets will perform poorly, when elsewhere another market is doing well. You can draw on the strengths of different asset classes to give you much smoother growth.

Why is diversification so important?

Too many traders focus on one asset class or market and assume that the recent performance will continue indefinitely. This has been particularly true in the last couple of years. With interest rates at all-time lows, stocks have been the only asset class for big hedge funds and asset managers to put their money in and expect a decent return. As such, the S&P500 has risen nearly 50% in the past 3 years (since November 2016). This is nearly 3x faster than the average growth rate of the S&P for the last 70 years. As such it has been easy for new traders to buy stocks with leverage and achieve unprecedented gains. They then assume this will continue indefinitely. The fact is, it won’t. Market conditions change, and you have to be able to adapt to them. How? Diversifying your investments.

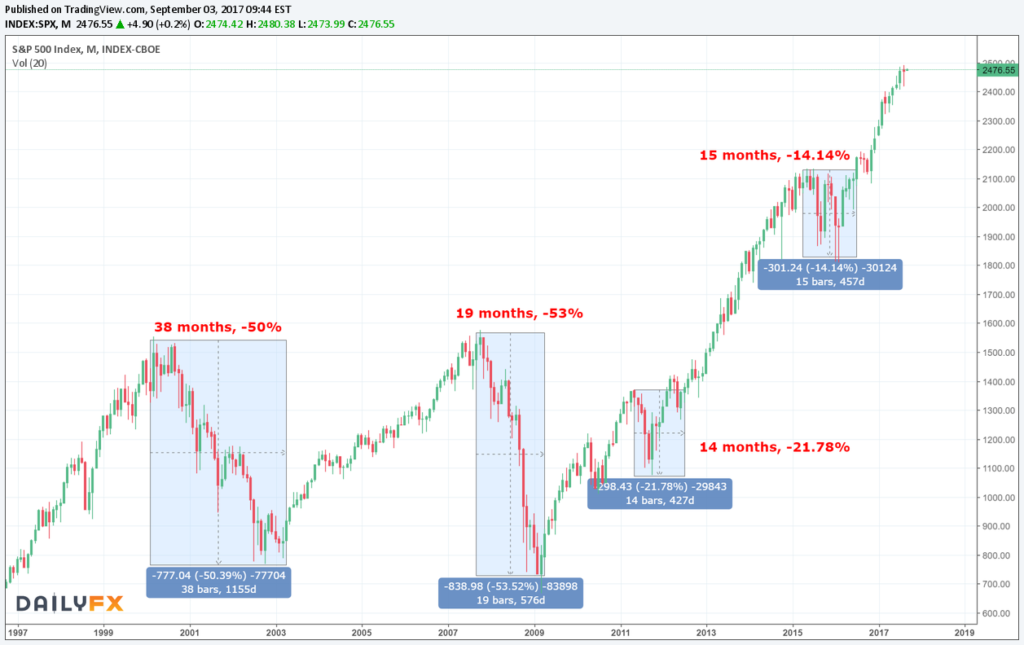

Example stock markets chart:

If you look at the long term chart of the S&P, you can see that the markets regularly go through very prolonged, deep drawdowns. If you’re just buying stocks, you’re going to have to suffer through these painful periods. Just look at 2001 to 2003 and 2007 to 2009, could you cope with a 50% drawdown?

Similarly, the last year has brought about some of the most unparalleled moves in cryptocurrencies. We have been able to make a lot of money from these, however, I traded these within a portfolio of 35 markets that I watch. I knew this explosive growth wouldn’t continue forever (otherwise we will see bitcoin trading above $1million in a few years….). Bitcoin is now trading at just above $4000, down nearly 80% from its high in December 2017. I feel sorry for the ‘hodlers’ who bought in near the highs, and now are facing massive drawdowns. Are you one of these people? Investors in cryptocurrencies have suffered from lack of diversification, placing all their eggs in one basket.

Simple Steps to Diversifying your Investments

1) Types of market (Commodities, Forex, Equities, Cryptocurrencies etc…)

Different market types are influenced by different factors. Commodities are more speculated, and are driven by global growth and demand. Forex is a function of individual economies and monetary policies. Equities (or ‘Stocks’) are driven by the performance of the individual companies (this may be a function of the state of the wider economy, but there are more specific factors at play – Earnings, product releases, management etc…). Whereas, cryptos are hugely speculated on, and very susceptible to market hype and hysteria.

As a result of these factors, different markets move in different ways and at different times. To be able to profit consistently, it is important to have a mixed portfolio. There is no point in making a fortune in one market in one period, just to lose it when the conditions change.

2) Market Correlations

It’s all well and good trading lots of different markets, but they also need to be uncorrelated. If you try and diversify by trading the pairs EURUSD, GBPUSD and USDJPY, they are all a function of USD. Similarly, there is no point in trading only Bitcoin, Ethereum, Dash and Litecoin, and expecting to perform as well in the long-run. Diversifying your investments through trading a variety of markets is essential – don’t restrict your trading to correlated markets.

3) Strategy Diversification

No strategy will work all the time, so as well as trading different markets, it can be useful to trade different strategies alongside each other. Although this requires more effort, if the market conditions favour one strategy then that will make money while the other loses and vice versa.

At TheTwoTraders we employ a swing trading system and a short term day trading strategy, as well as trading a large number of different markets. You can see which provider we trade with at the preferred brokers page.

By diversifying your investments, and trading approach, you could not only increase your growth potential but make your drawdowns smaller, and smoother. Learn more about how to improve your returns today.

The Two Traders

If you want to start trading click here or visit our Get The Trading Edge tab to start learning