Gaps

Gaps are areas on the chart where the price moves sharply up or down, with little trading in-between. This results in a ‘gap’ on the chart for the instrument. The gap remains intact if it is not ‘filled’. Gaps are not common in forex or commodity markets because of the high liquidity, however, they can occur over weekends (when the market is closed) if there is some news. These are more common for stocks.

Nonetheless there are 4 types of gaps you should be aware of. Note, as examples of this for forex markets are hard to come by, I have used examples for stocks instead.

1)Breakaway gaps: These signal the beginning of a new move. Often the price jumps out of a congested area (up for the start of a bull move, down for the start of a bearish move). A breakaway gap is significant because it signals the supply and demand balance of the market is in question. The pressure is so great that the market literally jumps to the next level. This leaves a lot of people on the wrong side of the market, who will be forced to liquidate eventually; this fuels the move even further.

2)Common gaps: The majority of gaps are likely to be filled sooner or later. Most gaps are filled within the same trading session or within a day or two. These are the most common and result from news that is not usually strong enough to cause a change to the major trend. The trick is to differentiate this type of gap from the others, which are useful indicators of trend changes.

3)Continuation gaps: These are found in the middle of powerful moves. The market gaps, usually on news, and continues along the trend without filling the gap. This again leaves a lot of players on the wrong side of the market, who have to liquidate their position and fuel the move further.

The example below shows all three of these gaps in play for TESLA INC stock in 2013. Notice how the price is in a period of consolidation before the breakaway gap. After the breakaway gap, the gap is not ‘filled’ (the market does not move back into the empty space). The stock price quickly runs up from 35 to 112 (And actually keeps going up to 290 after this!)

4)The final type of gap is an exhaustion gap. This happens near the end of a move and is a final attempt to hit new highs or lows. In a major uptrend, the market gaps up to new high, whereas in a major downtrend the market gaps down to new lows.

This occurs because the market has run out of steam. In a major uptrend, the last of the shorts have given up and are buying back their positions. The last of the ‘uninformed’ buyers are joining the move late because they still believe the market has some way to go. However, the market is saturated and high prices begin to reduce demand, whilst supply is increasing. With a major downtrend, the last of the buyers are under-margined and have given up. This is the beginning of the end because low prices have begun to stimulate demand.

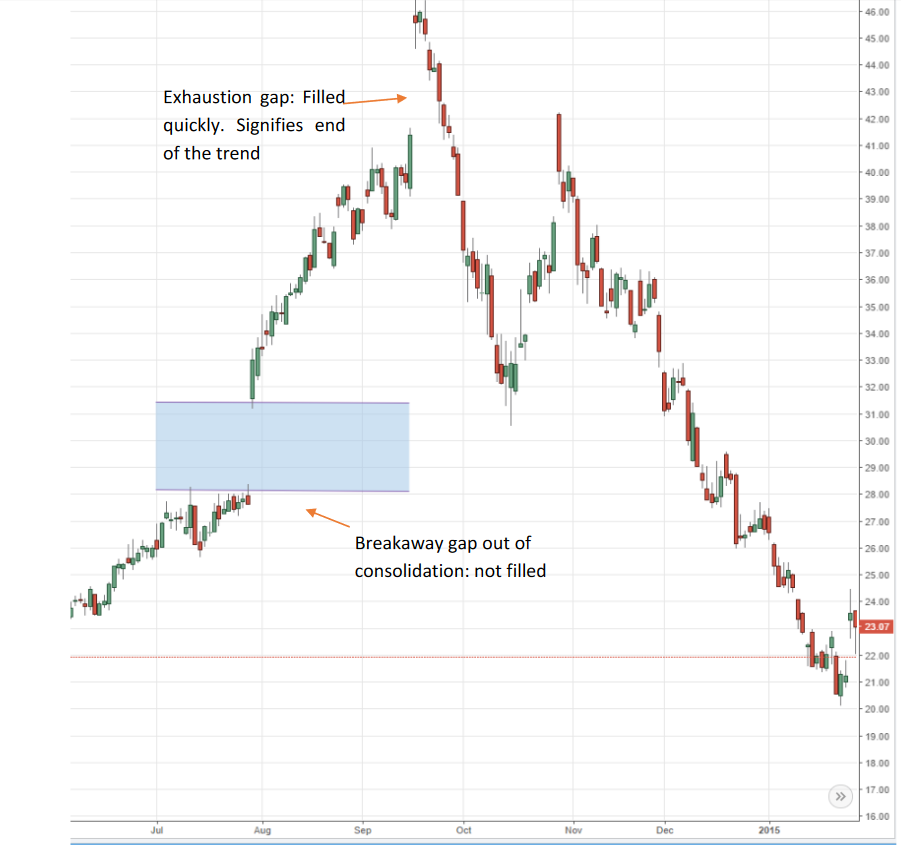

Unlike with breakaway and continuation gaps, exhaustion gaps are filled relatively quickly. The example below is for United States Steel Corp in 2014. Notice how the move starts with a breakaway gap, and quickly goes from 28-42. This then gaps up to 47 but there is not enough momentum to push any higher. The price quickly comes crashing back to 22 over the next few months. If you can spot moves like this and trade them correctly, there is an enormous amount of profit to be made.

How to trade gaps

You must acknowledge that most gaps will be filled. Do not look for significant gaps at non-significant times: E.g if a market gaps on minor news or what doesn’t appear to be a major top or bottom, it will probably be get filled.

1)If you spot a breakaway gap out of consolidation, enter a position on the day of the breakout, provided the gap is not filled. Place your stop loss at the far side of the gap: if the breakout is any good, your stop will not be hit.

2)Continuation gaps offer a good opportunity to add another position. If you are already in a positon (on the right side of the trend!) then you can add another position after a continuation gap, and move the stop loss of all your positions to the far side of the gap. This locks in profit and gives you an additional position for very low risk.

3)Never anticipate exhaustion gaps: Wait for them to be filled before taking a new position. These occur at the end of major moves where the market is volatile. It is difficult to determine where your risk point is until the exhaustion gap has been filled.

4)When you see a significant gap, act on them! These offer excellent risk to reward and if you learn how to trade them properly can become a powerful tool in your trading armoury.

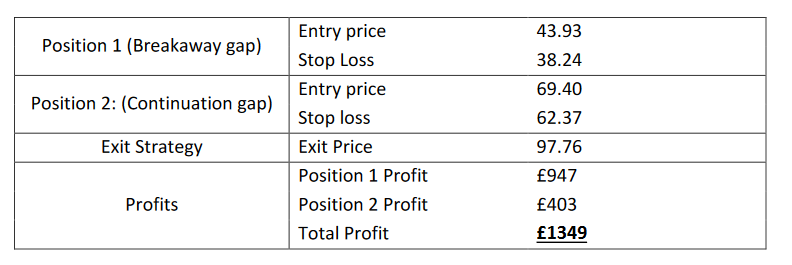

Applying these rules to the TESLA example above, you would enter two positions which would both see a significant profit, if you closed after the fill of the exhaustion gap. We will use an initial risk of £100 per position to calculate the profit from each position. The table below shows the breakdown for this move.