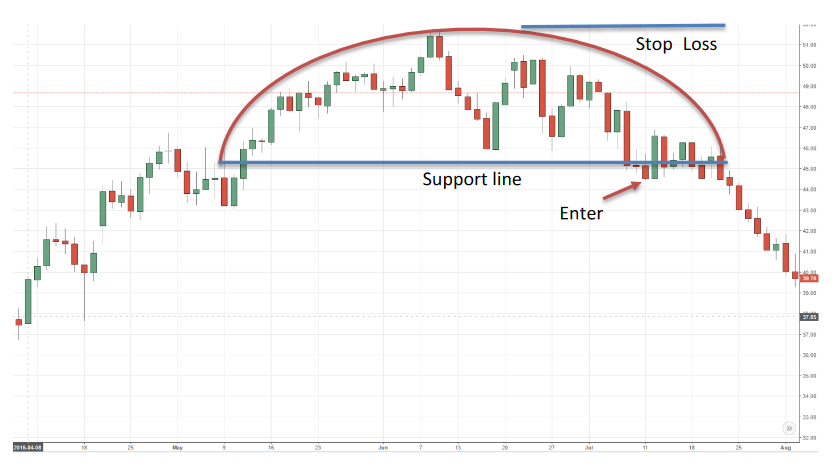

Rounding Tops and Bottoms

The Slower Reversal Pattern

Rounding tops and bottoms are another reversal chart pattern. This requires more patience to trade than other patterns as they are slower to develop.

For a rounding bottom, as the price moves lower, the rate of decline begins to slow down. This is followed by a period of range trading, which eventually shifts to an up-trend. The example below shows a rounding bottom for GOLD in 2016

For a rounding top, as the price moves higher, the rate of increase begins to slow down. This is followed by a period of range trading, which eventually shifts to a down-trend. The example below is for OIL in 2016.

These can be traded similar to the double tops or bottoms. You can enter a position when the price breaks the support level of the pattern in the opposite direction to the initial trend, with your stop loss above/below the rounding bottom (Above for a buy, below for a sell). You take a profit when your position reaches a 2 –3 times the value of your initial risk.