Trade Selection with “Filters”

Technical Indicators–Filters

Filter Basics

A filter is an indicator that determines a dominant trend or characteristic within the market. Once the filter has defined the dominant trend/characteristic, those trades in the opposite direction can be ignored. To summarise this, a filter is something you put in place to remove unwanted trading periods, such as a consolidating or volatile market.

The example discussed in this guide will be a moving average filter.

Moving average filters –‘The Trend is your Friend’

You may have heard the term ‘the trend is your friend’ before and although it is incredibly cliché, it is an incredibly powerful concept. The aim of the filter is to ensure you are only taking positions in the direction of the overlying trend.

Moving averages are the simplest and in my opinion the best indicators for determining the overall trend in the market. The moving average can take either the simple, weighted or the exponential form. The principle of a filter uses a moving average to determine the long-term direction of the market, with entry taking place using a shorter indicator.

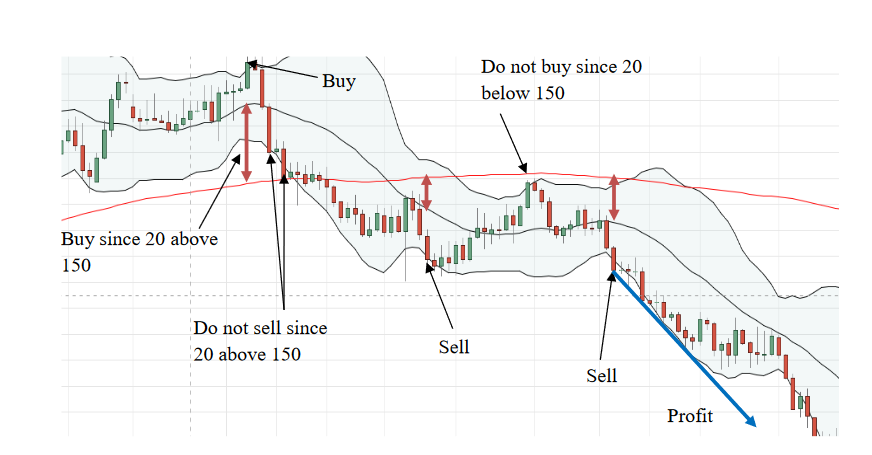

The chart below shows a 20-day Bollinger simple moving average (BSMA) using 2 standard deviation (SD) Bollinger bands with a 150-day SMA filter.

The example is for a price break out of the Bollinger band (see Bollinger band guide), but only selling/buying in the same direction as the filter. This system would work as follows:

Summary

- Filters are an excellent way to keep you from entering losing positions against the trend

- They are formed by using a longer term moving average and only buying/selling when:

a. Buying when shorter moving average is ABOVE longer

b. Selling when shorter moving average is BELOW longer