Money Management – Risk:Reward.

Risk to Reward

Risk to reward is another extremely important factor in trend following strategies. It underpins our teachings in the other guides, especially our stop loss, exit strategies and drawdown guides. Risk to reward allows a system to be extremely profitable without that same system having a good win %, where these systems can easily make a profit when the win rate is as low as 35%.

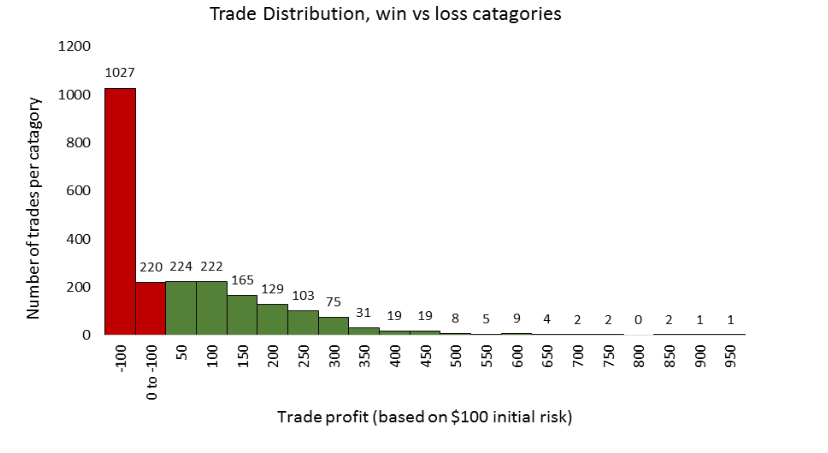

We will revisit the histograms from the loss aversion guide to explain this phenomenon. These histograms are based on our own backtested system using 2,268 trades over a period of almost 15 years for 22 different markets. As you can see there are 1,247 losses and 1,021 winners giving a win rate of 45%. On first glance, this system looks like it would not make any profit as you would lose more times than you would win.

However, your loss is capped at -$100 because you are an intelligent trader and you have set a stop loss which you would never change. Let’s pretend, for this example, your account size is $10,000, so this is a risk of 1% of your account each trade, a very sensible risk level. You also have an exit strategy which allows you to take more profit than your initial risk amount of -$100. Therefore, you can take profits in the region of $50 -$950as shown below. This is how risk to reward works. Say your next trade makes a profit of $300, that is a risk to reward of $300:$100 or 3:1 (convention tells us to call it risk to reward when it’s actually the opposite way around). This means you have gained back 3 losses. This allows you to lose more trades than you win, because you make much more profit when you win than when you lose with other trades that close due to your stop loss with the predetermined risk level of -$100.

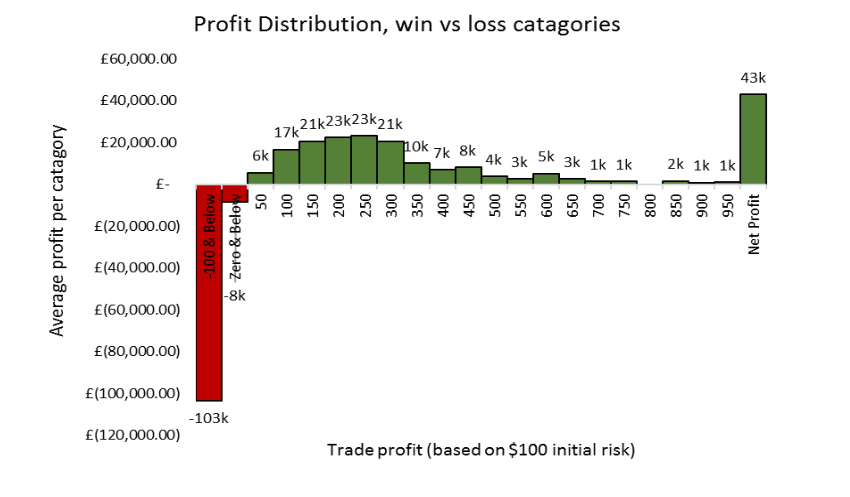

Now let’s look at this on a larger scale in terms of actual profit gained over the trading period for the same system. As I mentioned the win % is 45%, meaning you lose 55% of the time. The profit lost in this system is therefore any trade which closes below $0.00. Here there is $8,000lost by trades which close between -$100and $0.00and $103,000lost by trades due to the trade being closed at the stop lost using the predetermined risk level of 1%. Therefore, the total lost without position scaling is -$112,000. This is why losing is so hard to deal with, see our psychology guides for more on how to handle this.

However, because we are letting the potential maximum equity gained per trade exceed the potential maximum equity lost(i.e. the risk to reward is bigger than 1:1)the system can make an extremely good profit even though the win % is below 45%. Our unscaled net profit, basically the sum of all the categories, is $43k. When scaled this ensures the $43k is transformed into millions.

Notice that in the trade distribution graph above, the number of trades that made $250was 103 total trades. This number looks insignificant when compared to the number of trades than turn a profit of $100 and even smaller when compared with the 1,027trades that are stopped out. However, look at the profit distribution chart below, the trades which make $250have the greatest effect on the profitability of the system. This is because they offer a risk to reward of 2.5:1. This risk to reward means that a mere 103 trades can generate $23,000, clearly showing the power of holding your stop loss, allowing your profits to run with an exit strategy and using the risk to reward to your advantage.