Being successful isn’t a walk in the park. I’m not the most successful trader out there, but I have managed to achieve a lot in a short period of time. At 18 I started trading whilst at University. By 21 I was managing $300,000 of investors’ money. By 23 I have a track record that beats that of most hedge funds, I trade for private investors, and I have my own business whilst travelling around the world.

None of this came easy, but there are a few key habits that helped me to get to where I am today

1. Don’t settle for 9-5

This statement is twofold. First, if you are working a job you don’t LOVE, then don’t be complacent. You have one life, don’t waste it being miserable. I spent a year in a lucrative oil & gas role and could have settled for an easy lifestyle but instead, I chose to take a chance. Now I’m not saying you should up and quit your job, but it does lead to my second point:

There are 24 hours in the day. If you’re working 9-5, and you sleep 8 (this is being generous, you can live off much less) that gives you 8 more hours to be learning, practicing and studying. When I started learning to trade I would work my job 8-6 every day, come home and learn to trade until 2am before hitting the sack. This lifestyle was hard, and I wished someone had created a space for beginners.

2. Don’t be driven by money

This may sound counter intuitive, since the thing that probably got you reading a blog on a trading website was the desire for money. The issue lies in the fact that the more desperately you try and take money from the market, the more likely you are to throw your money away. You will take poor set-ups, you will trade too much, and you will inevitably take on excessive risk. This is what losing traders do, and what you should avoid at all cost.

You should be driven by high quality trading. There is nothing more satisfying than having profitable month after profitable month and the realisation that you are becoming a good trader. The money will come as a by-product, but you should focus on studying first. If you ‘learn before you earn’ you will have a much smoother ride. If you haven’t already, you should start learning now

3. Invest in yourself

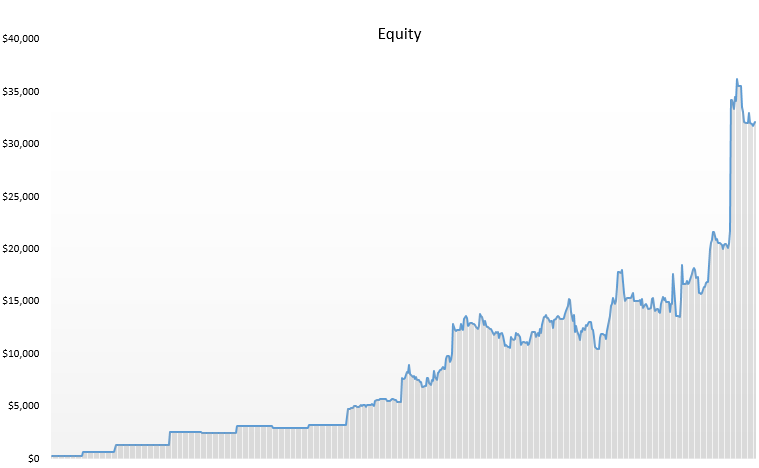

I have still never taken money out of my trading account. In fact, I try and get every penny I have in to the markets, and I have convinced half my family to invest in me too. Why? Because I have reached a level where I believe in my abilities.

You may not be there yet, but you should – at the very least – be reinvesting your profits in yourself; the exponential growth that comes from reinvesting returns is absolutely astounding. I see a lot of people who start making a small profit and are desperately trying to withdraw it, but I never understood why. Once you are consistent you can start to picture every pound you make turning in to another, and then another, and another… Reinvest in your bankroll or your bankroll will hold you back. I started with $270 and now trade nearly $40,000 (not including money I trade for others), because I reinvest every penny and more.

4. Learn… constantly

The best way you can invest in yourself is to invest in your mind. You should always be trying to learn new things, try new concepts, and ask new questions. Not only because it will help you develop further, but because it keeps things interesting!

Constant experimentation pays off. I had never traded a news event before November 2016, but I thought my system would work – so went for it in the name of science. Therefore I sat up all night watching the Trump Election with USDMXN (Dollar – Mexican Peso) open on the 5 minute chart (I had also never traded such a short time-frame). I got caught in 3 false breakouts (a loss of $600) before I caught the big move and took home $4000, simply because I was intellectually curious and wanted to try something new.

I also quickly learnt that one of the best ways to make more profit was by trading as many markets as I could.

5. Track your progress

If you don’t know where you’ve come from, how can you know where you’re going?

Take some time to step back and take a serious look at what you’ve been doing and what you’ve accomplished, because setting realistic goals can be both a very scary and humbling experience. Looking back at my trade history and my P/L is sometimes a bit of shock because it’s too easy to get caught up in what’s going on and forget that you’ve lost trades in the past. I now note down my equity every night, calculate how much of a drawdown I’m in, and look back through my trades every month. This way I know exactly how I’m progressing at all times, and you very quickly learn what’s working and what isn’t. It’s a good habit to get into to keep you on the right path and help find out what works for you

The Two Traders

If you want to start trading click here or visit the Trading Course tab to start learning